Uber’s Revenue Craters, as Deliveries Surge in Pandemic

OAKLAND, Calif. — Uber is synonymous around the world with ride hailing. But as the coronavirus pandemic shows few signs of loosening its grip, the company may become more closely associated with another business: delivery.

Uber said on Thursday that its ride-hailing business had cratered in the second quarter as people traveled less in the pandemic. The company’s revenue fell 29 percent to $2.2 billion from a year ago — the steepest decline since its initial public offering last May — as its net loss totaled $1.8 billion.

But its Uber Eats food delivery service surged, with revenue more than doubling from a year ago to exceed that of ride hailing for the first time. Revenue for Uber Eats soared to $1.2 billion, while rides came in at $790 million.

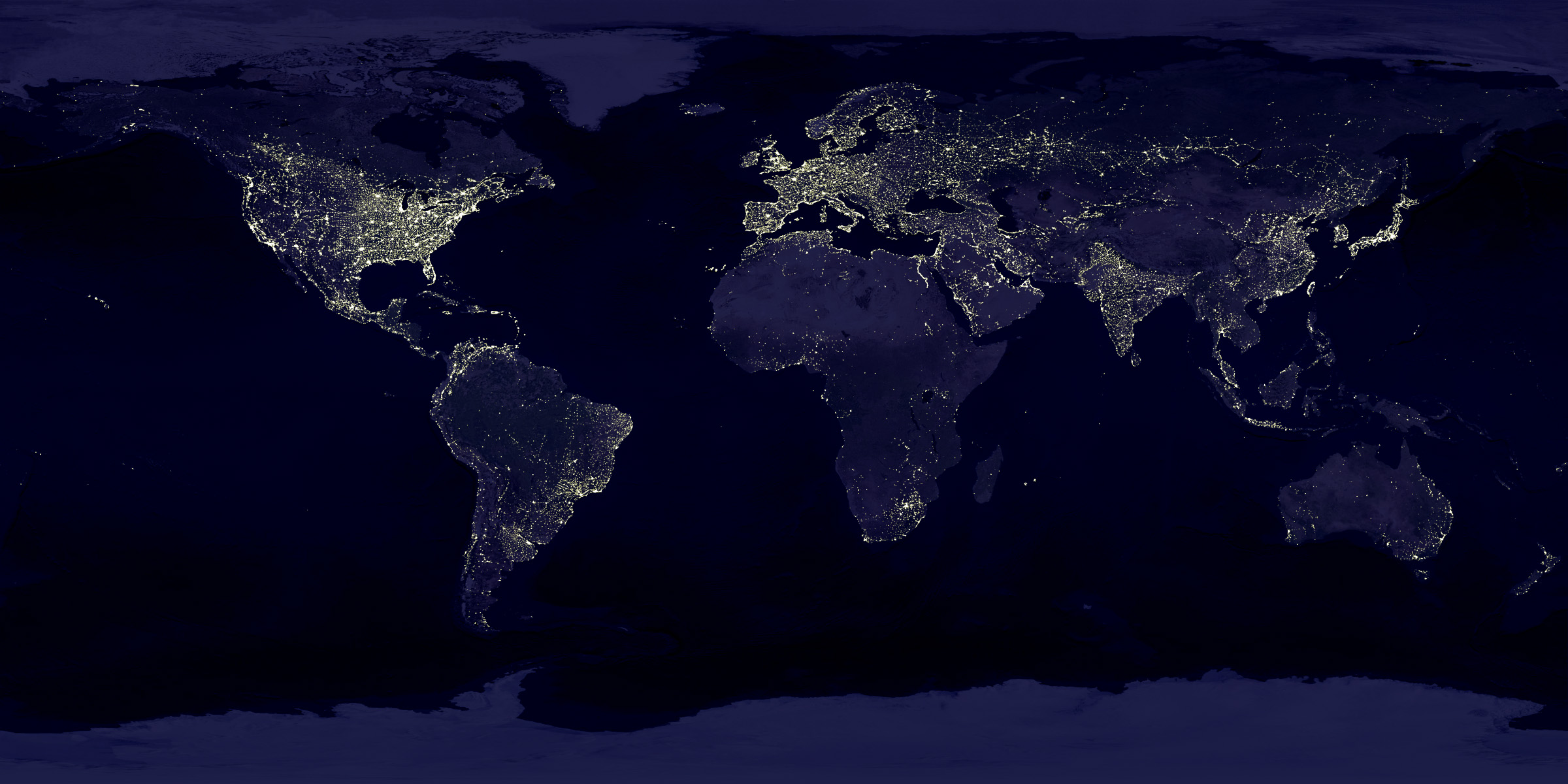

Dara Khosrowshahi, Uber’s chief executive, said in a call with investors on Thursday that the varied pandemic responses around the world had created “a tale of 10,000 cities” for the company, with business recovering in some regions and not in others.

In spite of the challenges, he said delivery was “a very high-potential opportunity” for Uber to expand even further by offering deliveries of home goods, prescription medications and pet supplies.

Uber has doubled down on food delivery in recent months. In May, Mr. Khosrowshahi sought to acquire Grubhub, a delivery service, but the companies struggled to agree on terms and to deal with potential antitrust scrutiny. Last month, Uber said it would instead acquire the delivery service Postmates in an all-stock deal valued at $2.65 billion.

Buying Postmates is expected to give Uber roughly 35 percent of the U.S. food delivery market, analysts said. That would allow Uber to challenge the delivery leader, DoorDash, which is estimated to have a 45 percent market share. The mixed results sent Uber’s share price down more than 2 percent in after-hours trading.

“Right now, they are swimming in the red ink,” said Dan Ives, managing director of equity research at Wedbush Securities. “Investors are still giving them the benefit of the doubt because of Uber Eats.”

Uber has consistently lost money, and Mr. Khosrowshahi remains under pressure to make it profitable. The company’s net loss in the second quarter narrowed from $5.2 billion a year ago, when it was dealing with stock-based compensation costs from its initial public offering. Uber said it still intended to become profitable sometime next year.

The company also said there were some signs that its rides business was improving internationally. In France, business had recovered about 70 percent, it said, while rides to work and to social gatherings in places such as Hong Kong, New Zealand and Sweden were higher than they had been before the pandemic.

But in the United States, which is one of Uber’s largest markets, rides were down 50 percent to 85 percent in many major cities.

Uber also faces legal challenges in California and Massachusetts, where the state attorneys general have sued Uber and Lyft for violating labor law. Drivers in both states should be classified as employees, not independent contractors, and be entitled to full employment benefits, the states have said.

If the lawsuits are successful, they could diminish Uber’s business because it would make it more expensive to operate, analysts said.

“It will be hard to argue that Uber and Lyft are the future of transportation,” said Tom White, an analyst for D.A. Davidson. “These guys will look a lot more like tech-centric, tech-smart taxi operators.”

Most drivers prefer to remain independent contractors, Mr. Khosrowshahi said. “We are confident in our position,” he said.