JPMorgan's global M&A head Aiyengar says More mega deals are on the way

Companies worldwide are pursuing larger deals in the second half of this year as executives grow increasingly comfortable navigating volatile markets and unpredictable global politics, JPMorgan Chase dealmakers predict.

Mergers and acquisitions have been regaining momentum after earlier disruptions caused by U.S. President Donald Trump's trade war, which slowed the market in April. According to JPMorgan—the largest U.S. bank and the world’s second-biggest dealmaker—global M&A volumes jumped 27% in the first half of the year to $2.2 trillion compared to the same period last year, supported by a 57% surge in mega deals valued above $10 billion.

Anu Aiyengar, JPMorgan’s global head of advisory for mergers and acquisitions, said there has been a shift in mindset from waiting for certainty to actively managing uncertainty. “Boards are encouraging management teams to think big, think bold and act instead of waiting for certainty,” she said in an interview discussing the bank’s mid-year M&A outlook.

Against a backdrop of volatile markets and multiple conflicts, corporate leaders are targeting transformative mega deals—generally those worth $10 billion or more—to strengthen supply chains and advance technology amid growing uncertainty.

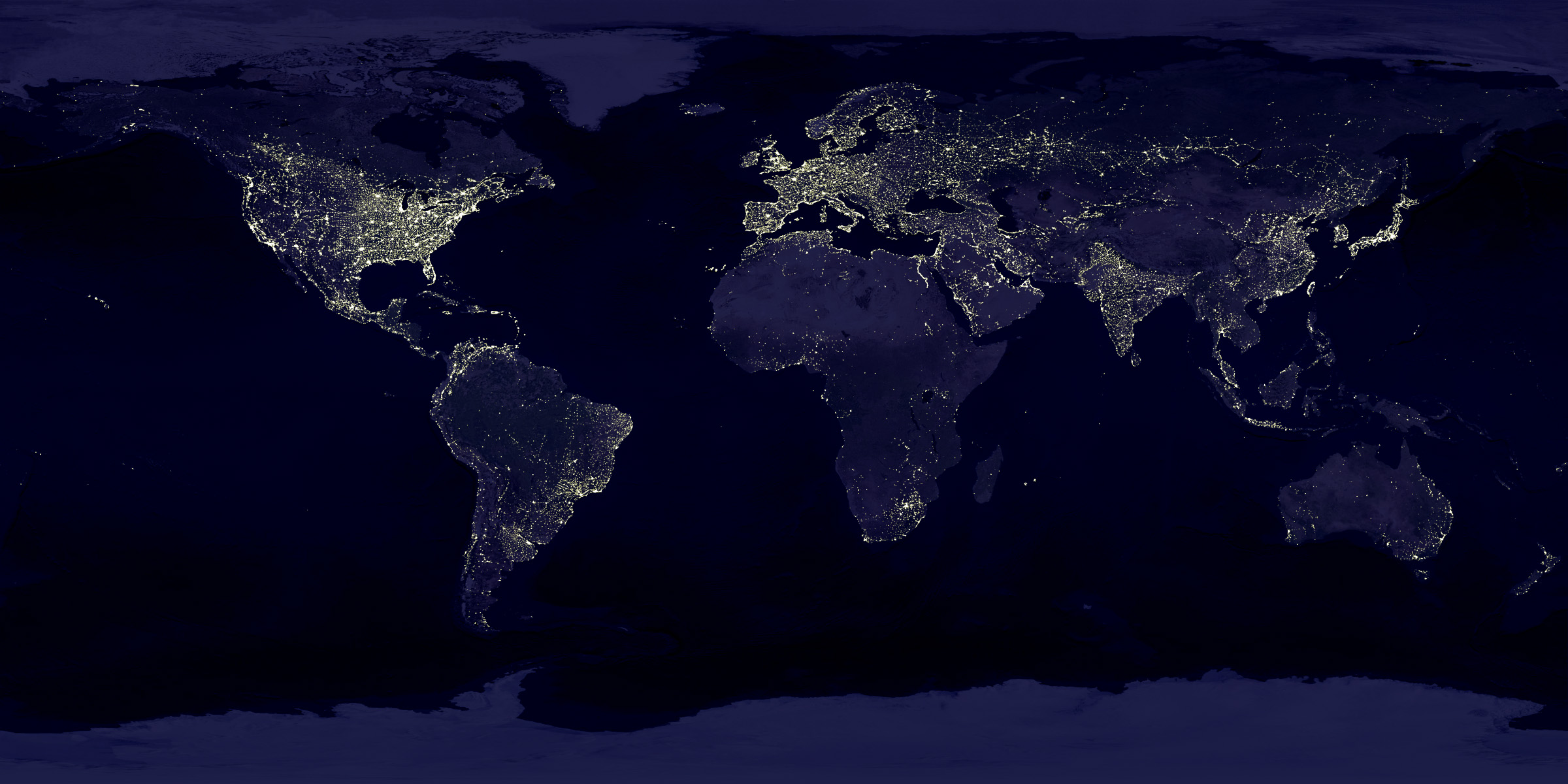

Cross-border deal activity remains strong despite heightened regulatory risks, JPMorgan’s investment bankers noted, emphasizing the crucial importance of scale for large multinational companies facing increasing political protectionism, market instability, and rapid technological change.

Keeping pace with fast-evolving and costly AI innovations is expected to drive substantial dealmaking in the latter half of the year. JPMorgan estimates the AI market will expand to $1.8 trillion by 2030 from $60 billion in 2022. Currently, 40% of American businesses buy AI tools—double the percentage from last year—and tech companies are projected to invest $1 trillion in data centers over the next five years.

According to Aiyengar, the market is rewarding deals that provide scale, as smaller transactions around $500 million generally lack the impact needed to solve operational problems or enhance shareholder value. “Because the problems you need to solve are big, dipping your toe into it doesn’t work. You need to do something meaningful,” she explained

The most active sectors expected for the rest of the year include technology, industrials, and energy. Deal activity in Asia nearly doubled in the first half compared to the prior year and shows no signs of slowing, JPMorgan added.

However, the U.S. market remains the hottest—and often most expensive—place to invest right now. “The market here is bigger. Consumers are more resilient, and companies are able to respond faster. Generally, agility and nimbleness are higher, making this market even more attractive amid volatility,” said Aiyengar.